The Role of Artificial Intelligence (AI) in the Disruption of the Financial Sector: Potential Marketing Implications

1. Research Title

The title of this study is: ‘The role of artificial intelligence (AI) in the disruption of the financial sector: Potential marketing implications’.

2. Research Background

AI is widely acknowledged to play an important role in the contemporary business world (Davenport & Ronanki, 2018). Various AI models, including machine learning, deep learning, decision trees, and support vector machines (SVM) are now commonly employed by business entities to make their operations more effective and efficient (Bock et al., 2020). AI is one of the key technologies that have made a prominent difference in how companies conduct business, starting from performing marketing and executing administrative duties to undergoing human resource practices and forecasting changes in consumer behaviour (Canals & Heukamp, 2020). In the automotive industry, for instance, there is a growing trend towards using AI as a driving assistant and manufacturing driverless cars fully powered by this technology (Wang et al., 2022). In turn, creative services, such as advertising and marketing agencies, actively use AI to get a better understanding of consumer needs and preferences and provide their target audiences with relevant and interesting ads (Anderson & Coveyduc, 2020). By collecting and analysing big data and applying machine learning to consumer behaviour patterns, advertisers and marketers are now able to offer engaging content and, hence, more effectively persuade consumers to buy products and services (Canals & Heukamp, 2020).

With that being stated, the penetration of AI into industries is not even, which has resulted in serious differences in how companies use AI-powered technologies. It is commonly acknowledged that highly regulated industries would be the last to be disrupted by and take advantage of AI (Doumpos et al., 2022). The point is that these industries have to comply with numerous complex regulations and rules, making it challenging to design AI-powered solutions tailored to the needs of these specific industries (Ahmed et al., 2022). The financial sector could be attributed to highly regulated business areas due to great public interest (Fraisse & Laporte, 2022). After the recent 2008 global financial crisis, several problems, including the lack of alignment between financial institutions and the disjuncture between national supervision and globalised markets have emerged. Tackling these issues required regulatory reforms, which partly explains why the financial sector is one of the most heavily regulated industries (Ahmed et al., 2022). Strict regulation allows for preventing market failure, mitigating the impacts of financial failures on the economy, protecting investors, and promoting financial and economic stability (Canals & Heukamp, 2020).

Still, it would be wrong to assume that financial companies have not adopted AI-powered solutions. Despite operating in a heavily regulated environment, some financial services organisations have implemented AI in their revenue generation and risk management operations and processes (Doumpos et al., 2022). Some bank apps also use AI-powered virtual assistants to improve the quality of customer service and experience (Ameen et al., 2021). At the same time, many potential benefits of using AI models are yet to be enjoyed by financial companies. One of the areas, in which the implementation of AI-powered solutions could be beneficial, is marketing (Fraisse & Laporte, 2022). For example, commercial banks could use AI to get a better understanding of what financial services consumers need, as well as to promote and sell these services based on what consumers demand. Another potential application of AI in the banking sector would be the approval process for a mortgage. During this process, AI-powered software would collect all the possible information and data on an individual looking for a new mortgage and, based on the analysis of this data, would decide whether to approve the mortgage loan or not (Hu & Su, 2022).

3. Preliminary Literature Review

AI is one of the technological ‘marvels’ of the 21st century, which can be defined as a technology that enables a digital computer, machine, or robot to perform tasks that require human intelligence (Akerkar, 2019). From this definition, one can assume that AI is the simulation of human intelligence in computer and software applications that are designed to think like we do and mimic our actions. However, the concept of AI as given in the definition above has some fundamental flaws, which should be mentioned, though they are not the focus of this study. Although human beings are commonly viewed as rational decision-makers, their cognitive biases can lead to mistakes (Canals & Heukamp, 2020). Since AI is the simulation of human intelligence, there is a possibility that an AI-powered computer or software would also make a mistake. This assumption could be substantiated by the fact that intelligence comes from learning and systems have to train to learn to detect the right patterns and act as expected (Devang et al., 2019). Therefore, during the learning period, AI can potentially make mistakes due to the lack of intelligence.

The application of AI by business entities was doubted by many previous scholars because of the enormous costs of implementing, handling, maintaining, and updating AI-powered solutions (Königstorfer & Thalmann, 2020). However, with the emergence of Industry 4.0, the integration of AI and other technologies in companies’ production facilities and operations has become much more affordable (Wang et al., 2022). Today, AI provides companies with multiple business growth opportunities and possibilities; allows for better addressing ever-changing consumer needs; and enables them to more accurately predict industry and market changes and trends (Anderson & Coveyduc, 2020). Canals & Heukamp (2020) argued that the application of AI had enabled companies to get a better understanding of the situations, as well as internal and external organisational environments. In turn, as noted by Najem et al. (2022), firms using AI can significantly improve the quality and effectiveness of their planning activities and communication with clients, customers, and suppliers. The most notable applications of AI in human resource management include employee motivation and engagement, recruitment practices, and employee performance assessment (Davenport & Ronanki, 2018).

When it comes to the marketing domain, the use of AI has also been widespread. The existing literature indicates that many marketing functions benefit from the implementation of artificial intelligence, starting from customer service and marketing communication to actionable analytics and marketing strategy development (Devang et al., 2019). For instance, AI-powered marketing activities enable business entities to take into consideration consumers’ experiences, values, and attitudes to offer them satisfactory sales support. In accordance with Rodrigues et al. (2022), organisational resources that directly support the success of a bank’s sales team, including marketing materials, sales scripts, and sales software, play a crucial role in the extent to which consumers are satisfied with its financial services. Hence, by adopting AI-powered marketing solutions, financial services organisations can collect a customer’s purchase data and come up with specific instructions tailored to the needs of this particular customer (Anderson & Coveyduc, 2020). This, in turn, leads to a higher level of customer satisfaction and enhanced customer experience, resulting in better organisational performance (Dimitrieska et al., 2018). However, this statement only applies to a firm’s existing customer base, whereas the extent to which AI can enhance the experiences of those consumers who have not purchased anything from this firm is debatable.

As previously noted, the extent to which AI is used in the financial sector is limited due to it being heavily regulated. Still, the body of literature that addresses the issue of using AI-powered solutions in this context is growing. For example, Doumpos et al. (2022) noted that commercial banks rely on AI to improve the quality and effectiveness of their decision-making process and more accurately forecast possible changes in the external environment. The analysis of large amounts of industry and market data enables these companies to improve their risk management strategies and approaches, which play a crucial role in their competitiveness and viability (Akerkar, 2019). In turn, according to Mogaji et al. (2021), financial service organisations rely on AI to better understand the needs and expectations of their esteemed clients and provide them with highly personalised services. Moreover, commercial banks use AI-powered software like chatbots to provide their prospective clients with relevant information and suggestions about their services (Huang & Lee, 2022). Still, the effectiveness of this marketing instrument is limited as chatbots can only answer relatively simple questions, whereas their ability to engage consumers in a human-like conversation is not great (Wang et al., 2022).

4. Research Gaps and Conceptual Framework

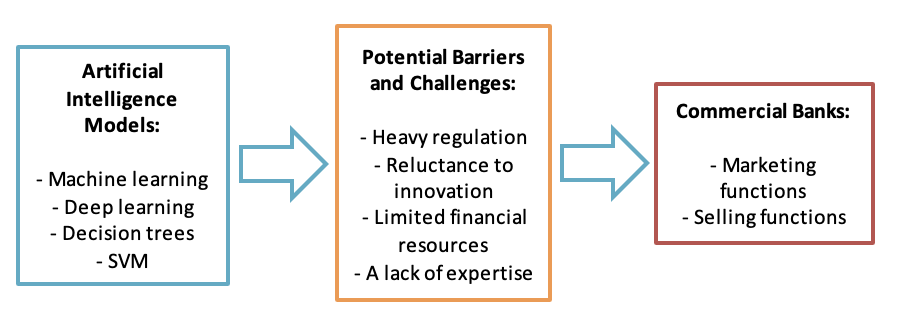

As the background literature review has indicated, financial service organisations to a considerable extent have implemented AI-powered solutions. Some of the areas of corporate governance that got the most out of these solutions include risk management, human resource management, and revenue generation (Ngai et al., 2011). At the same time, one of the research gaps that this study will attempt to bridge refers to the examination of the extent to which AI is used by commercial banks for marketing purposes. Specifically, the existing body of literature does not specify how AI could assist financial service organisations with selling activities, such as the approval process for a mortgage, ensuring predictive and actionable analytics, or providing improved product and service recommendations (Bock et al., 2020).

Another research gap that should be addressed refers to the reasons why the financial sector lags behind many other industries in terms of AI implementation. Being heavily regulated is widely acknowledged as the key reason behind the failure of the financial sector to actively use AI-powered solutions for marketing and selling purposes (Königstorfer & Thalmann, 2020). Still, there might be other external and internal factors that hamper the development of AI technology within this context, which are worth investigating. For example, limited financial resources or the lack of expertise in implementing and using AI-powered solutions could be among these factors (Anderson & Coveyduc, 2020). Based on the preliminary literature review and the identified research gaps, the following conceptual framework has been designed.

Figure 1: Conceptual Framework

Source: Based on Anderson & Coveyduc (2020, 82), Devang et al. (2019, 28), Doumpos et al. (2022, 1)

5. Research Methodology

Ontologically, this study is relativist because the researcher believes that each financial services organisation exists in a unique context determined by its internal resources and capabilities, as well as external challenges, pressures, and opportunities. Therefore, the managers of different companies are likely to have different perspectives on why AI has not been properly implemented in the financial sector and how it could further enhance and improve the marketing and selling functions of their organisations. The researcher will attempt to examine this diversity of opinions and worldviews and interpret them in a rich context (Goddard & Melville, 2007). However, given that this ontological position implies the existence of multiple realities, the extent to which the produced findings could be generalised to all commercial banks in the UK is limited.

From an epistemological perspective, the philosophy of social constructivism, which implies that meaning and knowledge are generated by an interplay between the object and the subject, has been adopted (Howell, 2012). The participants’ perceptions of and attitudes towards the concept of AI and its role in the financial sector will be co-constructed by the researcher’s own interpretation and viewpoint. The same is true with respect to the analysis process. Although the managers of large commercial banks operating in the UK will provide data, it will be processed, analysed, and interpreted by the researcher, suggesting that knowledge and meaning will be co-created. While following the social constructivism stance enables the researcher to acknowledge the role of the context in the study, this epistemology accepts respondent and researcher bias, which means that the validity and reliability of the produced empirical findings should be approached with caution (Easterby-Smith et al., 2012). The researcher has adopted the methodological approach of interpretivism, which is concerned with gaining a deep understanding of the surrounding reality rather than explaining why the selected research phenomenon works in the way that it does.

Based on the epistemological, ontological, and theoretical choices made by the researcher, the role of AI in the financial sector will be investigated using semi-structured interviews. Hence, this study will be qualitative and follow a mono-method research design (Hallebone & Priest, 2017). In total, the researcher is planning to gather primary qualitative data from at least 20 top managers of several leading commercial banks located in London. To make sure the project sticks to its schedule, which can be found in the following section, a purposive sampling technique will be employed. This non-probability sampling, which is also known as judgemental sampling, implies approaching participants based on the researcher’s judgement, as well as their suitability and accessibility (Novikov & Novikov, 2013).

Before gathering primary data, the researcher will obtain the written consent of all interviewees to make sure their decision to participate is voluntary (Easterby-Smith et al., 2012). They will also be provided with an information sheet that will contain detailed information about this academic project, as well as the terms and conditions of participation. This procedure is thought to make sure an interviewee’s decision to particulate is informed (Bryman & Bell, 2015).

The collected primary qualitative data will be processed using thematic analysis, which enables the researcher to focus on identifying and describing ideas and themes within the data set (Novikov & Novikov, 2013). First, the collected data will be transcribed so the researcher could analyse it thematically. Afterwards, the researcher will create codes according to the main themes of this academic project, including AI, marketing functions, selling functions, consumer behaviour, and corporate governance. Finally, the coded data will be synthesised into themes that will emerge during the data analysis process. All the thematic analysis procedures will be performed using NVivo and its built-in instruments.

6. Time Frame

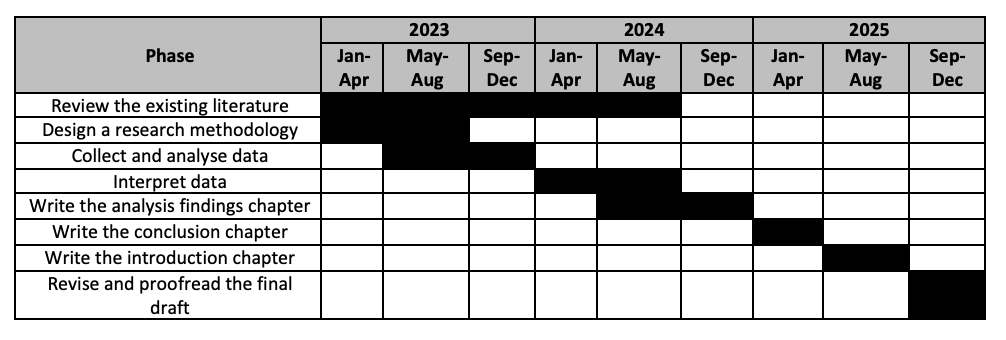

The following Gantt chart summarises the main phases of this academic study and specifies how much time each of them is expected to take.

Table 1: Project Schedule

Source: Constructed for this study

Barring unforeseen events, it is expected that the researcher will need approximately 3 years of full-time research to complete this PhD project.

7. Study Significance

This study is expected to shed light on the extent to which AI is implemented and embedded into the business operations of the leading financial services providers in the UK in general and their marketing and selling functions, in particular. In addition, this project is expected to make a contribution to the existing body of knowledge by identifying why the financial sector lags behind many other industries in terms of using AI-powered solutions for marketing and selling purposes and how this situation could be remedied. Based on this knowledge, it will be possible to provide the marketing managers of the target companies with practical recommendations as to how the incorporation of AI technology could contribute to their desired marketing objectives and outcomes.

8. Limitations

Since this project is interpretivist and constructivist in nature, the extent to which its empirical findings are generalisable is limited. As previously noted, the significance of context in the role that AI plays in financial companies’ marketing activities is considerable, which means that each commercial bank is likely to face a unique set of challenges and barriers to the implementation of AI technology. While these outcomes could potentially be extrapolated to large commercial banks located in the UK, their relevance to financial services providers in other geographical contexts is questionable.

References

Ahmed, S., Alshater, M., El Ammari, A., & Hammami, H. (2022). Artificial intelligence and machine learning in finance: A bibliometric review. Research in International Business and Finance, 61(1), 101646. https://doi.org/10.1016/j.ribaf.2022.101646

Akerkar, R. (2019). Artificial intelligence for business. Springer.

Ameen, N., Tarhini, A., Reppel, A., & Anand, A. (2021). Customer experiences in the age of artificial intelligence. Computers in Human Behavior, 114(1), 106548. https://doi.org/10.1016/j.chb.2020.106548

Anderson, J., & Coveyduc, J. (2020). Artificial Intelligence for Business: A Roadmap for Getting Started with AI. John Wiley & Sons.

Bock, D., Wolter, J., & Ferrell, O. (2020). Artificial intelligence: Disrupting what we know about services. Journal of Services Marketing, 34(3), 317-334. https://doi.org/10.1108/JSM-01-2019-0047

Bryman, A., & Bell, E. (2015). Business research methods. Oxford University Press.

Canals, J., & Heukamp, F. (2020). The Future of Management in an AI World. Palgrave Macmillan.

Davenport, T., & Ronanki, R. (2018). Artificial intelligence for the real world. Harvard Business Review, 96(1), 108-116. https://hbr.org/webinar/2018/02/artificial-intelligence-for-the-real-world

Devang, V., Chintan, S., Gunjan, T., & Krupa, R. (2019). Applications of Artificial Intelligence in Marketing. Economics and Applied Informatics, 5(1), 28-36. https://doi.org/10.35219/eai158404094

Dimitrieska, S., Stankovska, A., & Efremova, T. (2018). Artificial intelligence and marketing. Entrepreneurship, 6(2), 298-304. http://ep.swu.bg/images/pdfarticles/2018/ARTIFICIAL%20INTELLIGENCE%20AND%20MARKETING.pdf

Doumpos, M., Zopounidis, C., Gounopoulos, D., Platanakis, E., & Zhang, W. (2022). Operational Research and Artificial Intelligence Methods in Banking. European Journal of Operational Research. https://www.sciencedirect.com/science/article/pii/S037722172200337X

Easterby-Smith, M., Thorpe, R., & Jackson, P. (2012). Management Research. SAGE.

Fraisse, H., & Laporte, M. (2022). Return on investment on artificial intelligence: The case of bank capital requirement. Journal of Banking & Finance, 138(1), 106401. https://doi.org/10.1016/j.jbankfin.2022.106401

Goddard, W., & Melville, S. (2007). Research Methodology: An Introduction. Juta and Company.

Hallebone, E., & Priest, J. (2017). Business and Management Research: Paradigms and Practices. Bloomsbury Publishing.

Howell, K. (2012). An Introduction to the Philosophy of Methodology. SAGE.

Hu, Y., & Su, J. (2022). Research on Credit Risk Evaluation of Commercial Banks Based on Artificial Neural Network Model. Procedia Computer Science, 199(1), 1168-1176. https://doi.org/10.1016/j.procs.2022.01.148

Huang, S., & Lee, C. (2022). Predicting continuance intention to fintech chatbot. Computers in Human Behavior, 129(1), 1-12. https://doi.org/10.1016/j.chb.2021.107027

Königstorfer, F., & Thalmann, S. (2020). Applications of Artificial Intelligence in commercial banks–A research agenda for behavioral finance. Journal of Behavioral and Experimental Finance, 27(1), 100352. https://doi.org/10.1016/j.jbef.2020.100352

Mogaji, E., Balakrishnan, J., Nwoba, A., & Nguyen, N. (2021). Emerging-market consumers’ interactions with banking chatbots. Telematics and Informatics, 65(1), 1-10. https://doi.org/10.1016/j.tele.2021.101711

Najem, R., Amr, M., Bahnasse, A., & Talea, M. (2022). Artificial Intelligence for Digital Finance, Axes and Techniques. Procedia Computer Science, 203(1), 633-638. https://doi.org/10.1016/j.procs.2022.07.092

Ngai, E., Hu, Y., Wong, Y., Chen, Y., & Sun, X. (2011). The application of data mining techniques in financial fraud detection: A classification framework and an academic review of literature. Decision Support Systems, 50(3), 559-569. https://doi.org/10.1016/j.dss.2010.08.006

Novikov, A., & Novikov, D. (2013). Research methodology: From philosophy of science to research design. CRC Press.

Rodrigues, A., Ferreira, F., Teixeira, F., & Zopounidis, C. (2022). Artificial intelligence, digital transformation and cybersecurity in the banking sector: A multi-stakeholder cognition-driven framework. Research in International Business and Finance, 60(1), 101616. https://doi.org/10.1016/j.ribaf.2022.101616

Wang, X., Lin, X., & Shao, B. (2022). How does artificial intelligence create business agility? Evidence from chatbots. International Journal of Information Management, 66(1), 1-8. https://doi.org/10.1016/j.ijinfomgt.2022.102535